The DTC 2.0 Reckoning: Why Digital-First Darlings Are Rewriting the Playbook

Under The Hood

How the pioneers of direct-to-consumer retail are pivoting from pure digital plays to omnichannel survival strategies

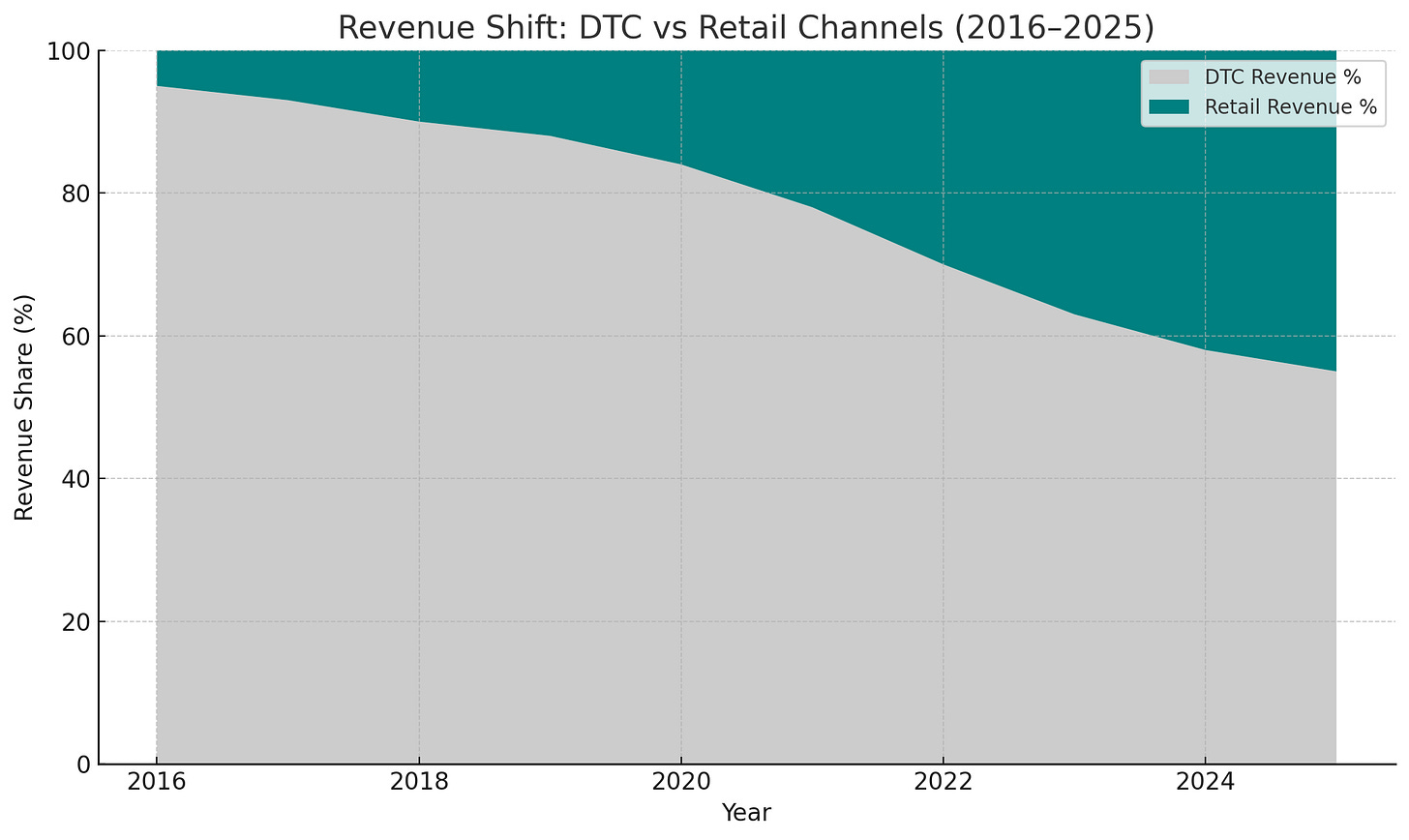

The direct-to-consumer revolution promised to rewrite the rules of retail. Cut out the middleman, build direct relationships with customers, leverage data for personalized experiences, and watch venture capital flow like water. For a golden period between 2015 and 2021, this playbook seemed unstoppable. Warby Parker disrupted eyewear, Glossier reimagined beauty, Casper promised better sleep, Allbirds offered sustainable footwear, and Away made luggage cool again.

But the revolution has hit a reckoning. Today, these once-unstoppable brands are laying off employees, closing stores, and fundamentally rethinking their strategies. The pure DTC model that once seemed like the future of retail is evolving into something more complex, more expensive, and far less certain.

The Golden Age That Wasn't

The original DTC thesis was intoxicating:

Better margins by selling direct

Personalized experiences at scale

Brand love through digital intimacy

And for a while, the numbers agreed. U.S. DTC e-commerce revenue tripled from $36B in 2016 to $128B in 2021. The pandemic poured gasoline on it. Everyone was home, online, shopping.

But the boom created a mirage. The pandemic didn’t confirm the DTC model; it distorted it. When the world reopened, brands were hit with rising acquisition costs, post-COVID churn, and operational strain.

Suddenly, the math stopped working.

The Reckoning: When the Numbers Stopped Working

The financial reality check began in earnest in 2022. Within weeks of each other, Glossier, Allbirds, and Warby Parker all announced layoffs as revenues flattened and growth stalled. The companies that had once been the darlings of the retail world were suddenly grappling with the same fundamental challenges that traditional retailers had faced for decades.

Let’s dive in.

Allbirds: From Sustainable Unicorn to Struggling Public Company

Allbirds epitomizes the DTC reckoning. The sustainable footwear company went public in October 2021 at $15 per share, valued at $2.2 billion. The timing couldn't have been worse. By Q2 2024, the company reported a devastating 26.8% year-over-year revenue decline to $51.6 million, while gross profit fell from $30.1 million to $26.1 million compared to the same period the previous year.

The Allbirds story reveals the core challenge facing DTC brands: unit economics that don't scale. Despite building a beloved brand around sustainability and comfort, the company struggled with customer acquisition costs that made growth increasingly expensive. Their early success in creating viral, word-of-mouth marketing proved difficult to replicate at scale.

The company's response has been to pivot toward an omnichannel strategy, expanding retail presence and diversifying beyond its core footwear offerings. But this pivot requires additional capital investment at precisely the moment when the company's cash position is under pressure.

Warby Parker: The Success Story with Caveats

Among the DTC pioneers, Warby Parker represents perhaps the most successful evolution to DTC 2.0. The eyewear company went public via direct listing in September 2021 and has shown more resilience than many of its peers. In Q2 2024, net sales increased 13.3% year-over-year to $188.2 million, while the company expanded its physical footprint to 256 stores.

But even Warby Parker's success story comes with important caveats. The company discovered early that omnichannel customers generate 65% higher customer lifetime value than pure online shoppers. This insight drove aggressive retail expansion, but also fundamentally changed the economics of the business. The company that once prided itself on cutting out retail middlemen now operates its own retail network, complete with all the associated real estate, staffing, and operational costs.

Warby Parker's financial statements reveal the complexity of the modern DTC model. While the company has achieved scale and maintains healthy gross margins, the path to sustainable profitability requires constant investment in new channels, customer acquisition, and operational infrastructure.

Casper: The Cautionary Tale of Mattress-in-a-Box

Casper's trajectory serves as perhaps the starkest warning about the limits of the pure DTC model. The company that pioneered the mattress-in-a-box category struggled with public market expectations after its IPO, ultimately being acquired by a private equity firm in 2021.

The Casper story highlights how quickly DTC advantages can be commoditized. Once the company proved that consumers would buy mattresses online, traditional mattress retailers like Purple and Tempur Sealy quickly adopted similar strategies while leveraging their existing supply chain and retail advantages. Casper found itself competing not just with other DTC brands, but with established players who could offer both online convenience and showroom experiences.

The company's financial struggles were evident in its public filings before the acquisition. Despite strong brand recognition and initial market leadership, Casper burned through cash while struggling to achieve the customer acquisition efficiency that would make the business sustainably profitable.

The Real Problem? The Margins Never Worked

At the core of every DTC flameout is the same issue: the unit economics never made sense.

The original thesis was that cutting out retail middlemen would mean better margins. But what actually happened? Digital got crowded. Paid ads got expensive. And CAC quietly killed the dream.

The iOS 14.5 update, which limited tracking capabilities for digital advertisers, particularly impacted DTC brands that relied heavily on Facebook and Instagram advertising for customer acquisition. Many companies saw their customer acquisition costs spike by 30-50%, fundamentally altering their growth equations.

Meanwhile, traditional retailers didn’t just sit back. They doubled down on digital, kept their in-store advantages, and made omnichannel feel effortless. DTC brands found themselves playing retail’s game, just with higher costs and thinner moats.

DTC 2.0: The Omnichannel Pivot

So what did smart brands do? They pivoted.

Today, over 80% of DTC brands with $50M+ in revenue have physical retail. The same founders who once swore off stores are now opening them because the numbers make it make sense.

Take Warby Parker: omnichannel customers are worth 65% more than online-only ones. Physical stores reduce CAC, drive retention, and create touchpoints that paid ads can’t.

But this shift isn’t plug-and-play. Retail ops, inventory management, and real estate are muscles DTC brands didn’t train for. And now they have to, fast.

The New DTC Playbook

The brands getting it right in this new era have a few things in common:

Capital Efficiency Over Hype: Growth at all costs is out. Profit discipline is in.

Omnichannel from Day One: No more treating physical retail as an afterthought.

Operational Maturity: Logistics, CX, and inventory strategy are now core.

Platform Agility: Amazon isn’t the enemy, it’s just another shelf.

Retail Didn’t Get Disrupted, It Got Smarter

This isn’t just a DTC correction. It’s a reflection of where retail is heading.

Legacy players have leveled up. Consumers expect seamless, everywhere experiences. And building a retail brand is easier than ever — but building a sustainable one? Still hard as hell.

So, What Now?

DTC isn’t dead. It’s just growing.

The winners of this new era won’t be the brands that shouted the loudest.

They’ll be the ones who run lean, think long, and execute relentlessly.

For founders, the message is clear: brand still matters. But ops matter more.

For investors: CAC, LTV, and margin integrity are no longer optional; they’re everything.

The revolution didn’t fail. It matured. The direct-to-consumer playbook is still being written, but it reads very differently now.

And with AI entering the mix, we’re just beginning to see how the next evolution will unfold.