The Rise and Fall of Sprinkles: What Brand Builders Must Learn from a 20-Year Journey

Under The Hood

On December 31, 2025, Sprinkles Cupcakes abruptly closed all company-owned locations, ending a 20-year run that transformed American dessert culture. For founder Candace Nelson, who sold the company to private equity firm KarpReilly in 2012, the news was devastating. “This isn’t how I thought the story would go,” she said in an emotional Instagram video. “I thought Sprinkles would keep growing and be around forever. I thought it was going to be my legacy.”

The complete story of Sprinkles—from its explosive growth to its sudden demise—offers critical lessons for brand builders about scaling, selling, and what happens when you hand your creation to someone else.

The Beginning: Building from Passion and Reinvention (2005)

Candace Nelson’s entrepreneurial journey began with loss. After working as an investment banker at Merrill Lynch during the dot-com era, she found herself laid off and deeply unfulfilled. Rather than jumping back into finance, she made a radical pivot: she enrolled in Tante Marie’s pastry school in San Francisco to pursue her passion for baking.

In 2005, at age 31, Nelson and her husband Charles opened the first Sprinkles location in a tiny 600-square-foot storefront in Beverly Hills that had previously been a sandwich shop. The concept was audacious in its simplicity: a bakery devoted exclusively to cupcakes, made with premium ingredients like Madagascar Bourbon vanilla, Belgian chocolate, and sweet cream butter. Each cupcake would feature a signature modern dot on top, a detail the Nelsons trademarked early on.

The response was immediate, and the shop sold out within hours on opening day. Celebrities like Tom Cruise, Oprah Winfrey, and Blake Lively became regulars.

What Nelson had created wasn’t just a bakery; it was a cultural moment.

For brand builders, Nelson’s origin story illustrates a powerful truth: sometimes your greatest advantage comes from being an outsider. Her investment banking background taught her to think about national expansion from day one. She later told interviewers that from the beginning, they invested more than needed for a typical bakery because they wanted a foundation for growth and envisioned it becoming a national brand.

The Growth Years: Innovation Meets Expansion (2005-2012)

Between 2005 and 2012, Sprinkles expanded from one Beverly Hills storefront to approximately 11 locations nationwide. The second location opened in Newport Beach, California, followed strategically by Dallas in 2007, the first expansion outside California. Nelson later explained this move was “very strategic,” proving Sprinkles wasn’t just a Southern California phenomenon but could work anywhere.

The brand’s growth was fueled by relentless innovation. In 2012, Sprinkles introduced the Cupcake ATM—24-hour vending machines that dispensed fresh cupcakes with a mechanical arm while playing the now-iconic “I Love Sprinkles” jingle. The machines became social media phenomena before Instagram was mainstream. That same year, they launched Sprinkles Ice Cream and created the “Sprinklesmobile,” billed as the world’s first cupcake truck. The company also sold cupcake mixes through Williams-Sonoma stores across the US and Canada.

Nelson also became a judge on Food Network’s “Cupcake Wars,” further cementing the brand’s position as the leader of the cupcake movement. Her television presence helped create word-of-mouth demand before new locations opened.

The Sale: When Founders Exit (2012)

In 2012, seven years after opening the first location, Candace and Charles Nelson sold Sprinkles to private equity firm KarpReilly LLC for an undisclosed sum. At the time, the company had 11 locations and was positioned for aggressive growth.

Nelson later explained her reasoning for selling: she considered herself “more of a creator than a person who runs a business.” The operational complexity of managing multiple locations, supply chains, and hundreds of employees had become overwhelming. She and Charles wanted a partner with operational expertise and capital to take Sprinkles to the next level.

From a brand builder’s perspective, this is the critical inflection point and the moment that contains perhaps the most important lessons of the entire Sprinkles story.

When founders sell to private equity, they’re making a fundamental trade: they’re exchanging control and long-term ownership for immediate liquidity and (theoretically) professional management expertise. KarpReilly was no stranger to the restaurant industry, with investments in chains like Marie Callender’s, Mimi’s Café, Café Rio, The Habit Burger Grill, and later Salt & Straw, HomeState, and Pitfire Pizza.

The sale seemed logical on paper. Sprinkles was thriving, growing, innovating. The Nelsons had proven the concept worked. A private equity firm with restaurant experience could provide capital and systems to scale nationally and even internationally. What could go wrong?

The Private Equity Years: Growth and Strain (2012-2025)

Under KarpReilly’s ownership, Sprinkles continued to expand aggressively. By 2023, the company had roughly 70 locations, including franchised units that began launching in 2022. The company announced ambitious plans to sign 100 franchise locations domestically, plus 100 international locations. They opened their first international location in South Korea in 2024 with plans to open 18 more international units that year.

They expanded into new product categories, such as gourmet chocolates in 2021, partnerships with Target and Walmart, and sugar-free pudding and pie mixes in 2024. They diversified the menu beyond cupcakes to include cookies, brownies, and layer cakes.

On the surface, this looked like the growth story the Nelsons had envisioned when they sold. But beneath the expansion, cracks were forming.

The cupcake craze that Sprinkles had ignited was cooling. Consumer preferences were shifting toward healthier options. Competition intensified as chains like Nothing Bundt Cakes expanded to 600 locations (with plans for 1,000 by 2027) and Crumbl reached 1,000 units. The novelty factor that once drove Sprinkles’ success had faded.

More fundamentally, the brand may have lost something intangible when the founders left. Candace Nelson had built Sprinkles around joy, quality, and creativity. Under private equity ownership, the focus inevitably shifted toward metrics, efficiency, and returns. Former employees commenting on Nelson’s Instagram posts after the closure hinted at declining standards under new ownership.

By the end of 2024, despite reporting $44.5 million in sales (a 3% increase from the previous year), something was fundamentally wrong. The company had 24 total locations (18 company-owned, 6 franchised). With $44.5 million spread across these units, the average revenue per location was less than $1.9 million annually, or roughly $650,000 for company-owned locations if franchised units generated less revenue. For a premium bakery with fresh ingredients and labor-intensive production, those economics were likely unsustainable.

The company was still announcing ambitious expansion plans, even teasing a new Burlingame location in December 2025—right up until the sudden shutdown.

The End: Closure Without Warning (December 2025)

On December 31, 2025, Sprinkles closed all company-owned locations abruptly. Employees reported receiving only one day’s notice on December 30th and no severance packages. The company cited moving to “transition away from operating company-owned Sprinkles bakeries” as the reason for closing. It remains unclear whether franchise locations will continue operating.

Candace Nelson learned about the closure just a few days before it happened. She no longer had any ownership or operational role in the company she’d founded 20 years earlier, yet she was the one who announced the news to devastated fans on Instagram on December 31st.

“Even though I sold the company over a decade ago, I still have such a personal connection to it,” she said in her video. “This isn’t how I thought the story would go. I thought Sprinkles would keep growing and be around forever. I thought it was going to be my legacy.”

The response was swift and emotional. Fans mourned the loss of a brand that had been part of their celebrations, birthdays, and traditions for two decades. Employees expressed anger at the sudden layoffs. And many commenters directed their frustration at both the private equity firm and Nelson herself for selling in the first place.

“Selling to private equity was the beginning of the end,” wrote one commenter.

“What did you expect? Private equity has literally NEVER made things better for customers, only for board members’ and investors’ pockets,” wrote another.

KarpReilly has not issued a public statement about the closure or the reasons behind it.

What Candace Nelson Did Next

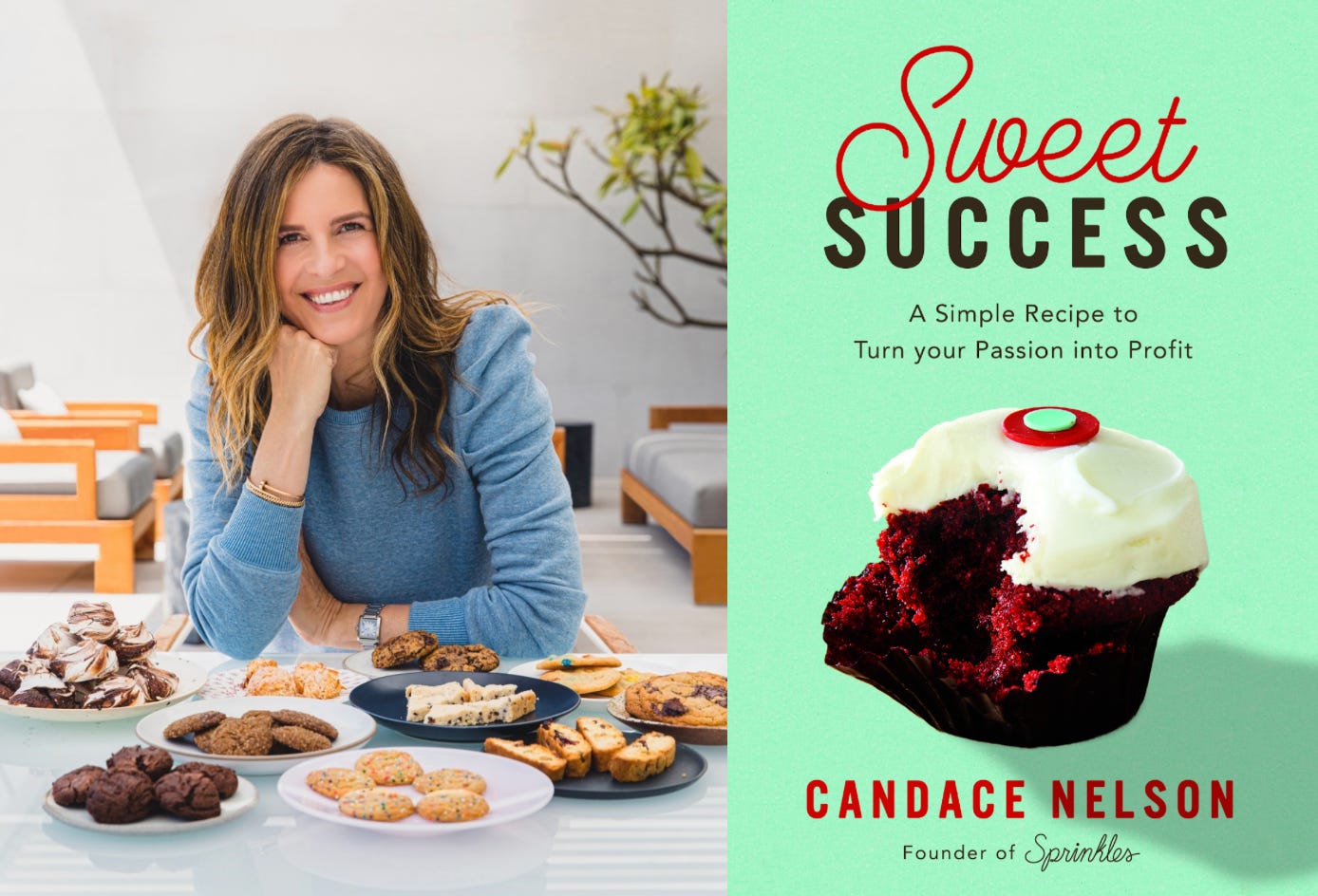

After selling Sprinkles in 2012, Nelson didn’t fade away. In 2015, she co-founded Pizzana, a Michelin Bib Gourmand-rated neo-Neapolitan pizzeria in Los Angeles, with pizzaiolo Daniele Uditi (and later partners Chris and Caroline O’Donnell). The restaurant now has eight locations, including Dallas and Houston. She became a guest shark on “Shark Tank,” a bestselling author of “Sweet Success,” an angel investor, and a sought-after keynote speaker on entrepreneurship.

She built a new identity beyond Sprinkles through her venture firm CN2 Ventures, which invests in “bold concepts and strong leaders,” helping other entrepreneurs avoid some of the pitfalls she experienced. She’s successfully reinvented herself as a serial entrepreneur rather than being defined solely by her first company.

In many ways, Nelson’s post-Sprinkles career validates her decision to sell. She’s created multiple ventures, influenced countless entrepreneurs, and built a diversified career in food and business. Had she remained tied to managing dozens of Sprinkles locations, she might never have had the time or energy for these other pursuits.

The Bottom Line for Brand Builders

The complete Sprinkles story from kitchen experiment to cultural phenomenon to sudden closure offers a master class in both the opportunities and risks of building, scaling, and selling a brand.

What Nelson got right: She identified a genuine market opportunity, built a category-defining brand with authentic founder passion, innovated constantly, and created something that brought joy to millions of customers over 20 years. She recognized when she’d reached her limits as an operator and made a rational decision to sell to experienced partners.

What went wrong (or at least differently than hoped): The brand outlived the trend it helped create, new ownership pursued growth that may have exceeded sustainable unit economics, the founder’s irreplaceable vision and standards were left with her, and private equity’s timeline and objectives didn’t align with building a multi-generational brand.

The hardest truth: There may have been no perfect path. Had Nelson kept the company, she might have faced the same market pressures and consumer preference shifts without the capital to adapt. The cupcake craze cooled regardless of ownership. But she would have controlled the ending and maintained her legacy intact.

For brand builders, the Sprinkles story is ultimately about understanding what you’re building and why. Are you building to sell? Then pick your buyer carefully, negotiate for commitments to quality and employees, and make peace with losing control of your creation’s fate. Are you building a legacy? Then prepare for the long, unglamorous work of managing a mature business through changing markets, and resist the siren call of acquisition offers.

There’s no wrong answer—only honest or dishonest ones.

For every entrepreneur building something they love, that may be the most important lesson of all: your brand is never fully yours once you sell it, no matter what the lawyers say or the contracts promise. Choose accordingly.

New article every Tuesday.

Be Bold. Be Real. Be Anomalous.