Two Celebrity Brands. One Clear Winner.

Under the Hood: A Case Study of Two Beauty Brands with different outcomes.

Two clean beauty brands. Two celebrity founders. One billion-dollar exit. One bankruptcy sale.

Introduction: Two Faces of Modern Beauty

In a market crowded with influencer-backed cosmetics and skincare brands, two celebrity-founded companies—Rose Inc. and Rhode—set out to redefine beauty in the 2020s. Both were helmed by internationally recognized faces: Rosie Huntington-Whiteley, the British supermodel known for her elegance and restraint; and Hailey Bieber, the American cultural icon whose every Instagram post rippled through Gen Z. Both had vision, clean formulations, and massive platforms. Yet just a few years in, only one remains standing.

This case study examines the diverging fates of Rose Inc. and Rhode, exploring product strategies, ownership structures, distribution models, and the deeper lessons about authenticity, equity, and endurance in modern brand building.

Part I: The Birth of Rose Inc. — Vision Meets Venture Capital

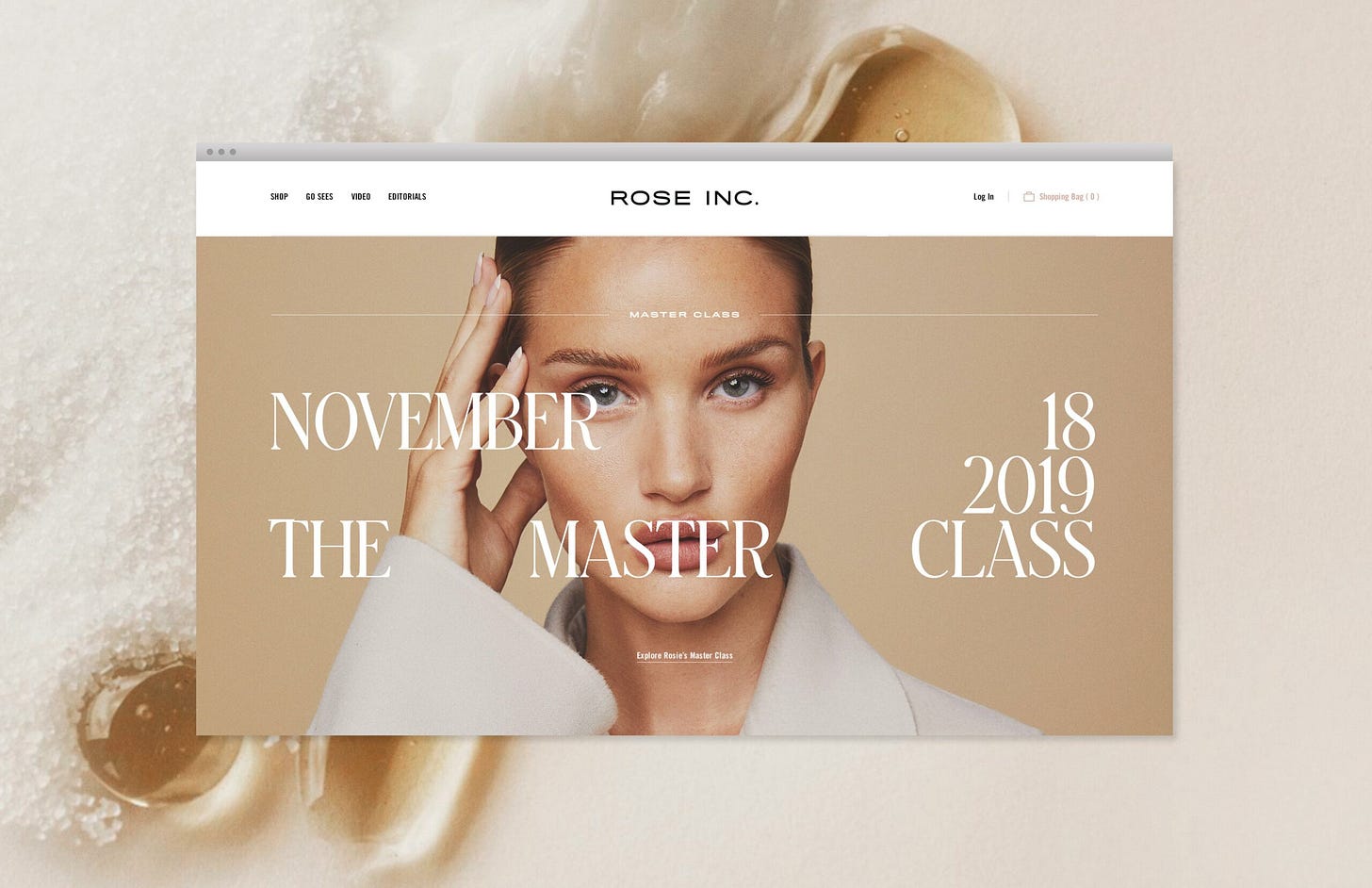

Rosie Huntington-Whiteley had long been admired for her signature style: neutral tones, clean lines, and timeless grace. In 2018, she extended that identity into Rose Inc., a content-driven beauty platform sharing tutorials, editorials, and insider tips. The platform was elegant, aspirational, and deeply curated, quickly building a loyal community.

By 2021, Rosie had evolved Rose Inc. from content into commerce. The brand became a clean beauty label in partnership with Amyris, Inc., a publicly traded biotech firm specializing in lab-grown, sustainable ingredients. Amyris supplied ingredients like squalane (a common skincare emollient, usually derived from sugarcane in their case) and served as the operational engine, handling research, development, logistics, and production.

Rosie retained approximately 40% equity in the venture. Amyris held a majority share, estimated at 56%, giving them financial control, ownership of product IP, and the ultimate decision-making authority. The promise was clear: biotech-backed clean beauty, delivered at scale, with Rosie as the creative voice.

Rose Inc. launched at Sephora U.S. and Space NK in the U.K., an enviable retail debut that most indie brands take years to achieve. The product line was extensive: skin tints, cream blushes, concealers, lip oils, and skincare. The visual language was sophisticated, the formulations clean and clinically tested. Everything seemed aligned.

But beneath the surface, the partnership was fragile.

Part II: Hailey’s Rhode — Small, Independent, and Strategic

Across the Atlantic—and in a very different beauty philosophy—Hailey Bieber was building her brand, Rhode. Rather than rushing to retail or launching dozens of products, Hailey spent several years developing Rhode as a direct-to-consumer (DTC) skincare brand focused on minimalism and daily essentials. She partnered with cosmetic chemist Ron Robinson and invested her capital, reportedly retaining between 50–70% equity in the company. Rhode was hers—not just in name, but in control.

When Rhode launched in 2022, it offered just three products: a peptide lip treatment, a barrier restore cream, and a serum. The aesthetic was minimal but warm. The prices were affordable but premium. Every product was part of a clear, personal narrative. Hailey didn’t just promote Rhode—she lived it. She used it in tutorials, on trips, and in get-ready-with-me videos. She wasn’t the face of Rhode. She was Rhode.

Importantly, Rhode was rejected by Sephora in early talks. The retailer believed the clean skincare market was too saturated. Hailey didn’t push. Instead, she built Rhode through drops, community engagement, viral TikToks, and organic storytelling. Each drop sold out in minutes. Waitlists ran into the hundreds of thousands. Rhode became a lifestyle brand before it even expanded into retail.

Part III: The Turning Point — Crisis at Amyris, Collapse at Rose Inc.

Despite its glamorous launch, Rose Inc. faced systemic issues tied to its structure. Amyris, its parent and supplier, was under increasing financial strain by 2022. Its broad portfolio of biotech ventures (including multiple beauty brands) overstretched its capital. Reports revealed growing losses, operational inefficiencies, and debt accumulation.

By 2023, Amyris filed for Chapter 11 bankruptcy. With it went the operational and financial backbone of Rose Inc. Rosie Huntington-Whiteley, who had never owned the majority stake, was left with limited recourse. She did not own the IP, supply chain, or even the backend logistics to continue the brand independently. And without Amyris, Rose Inc. couldn’t function.

In early 2024, the brand ceased operations quietly. No relaunch was announced. The website went dark. Rose Inc. vanished almost as quietly as it arrived, leaving fans confused and retail partners scrambling to discount inventory.

Part IV: Rhode’s Rise — Building from Community, Not Channels

While Rose Inc. faded, Rhode thrived. By 2023, the brand had expanded into Ulta Beauty and launched in the UK and Canada through its own e-commerce platform. New SKUs, including tinted lip treatments and a viral phone-shaped PR box, continued to sell out. Everything Rhode did was story-first, designed for shareability and emotional connection.

Rhode had become a modern skincare success story—largely because it never tried to be everything at once. Hailey focused on doing a few things well, building a clear identity, and maintaining control. Even without institutional investors or retail overreach, Rhode achieved a rumored $100M valuation by the end of 2024. Unlike Rose Inc., its infrastructure was scalable. Its founder was present. And its story was resonating.

Part V: What Every Founder Needs to Hear

The contrasting fates of Rose Inc. and Rhode offer deeper lessons for any founder, not just those with fame.

Protect Your Equity — Before You Do Anything Else

Don’t just sign the deal. Own the outcome. If you don’t control your equity, you don’t control your story. Rosie’s limited stake meant she couldn’t save Rose Inc. when Amyris collapsed. Hailey’s majority ownership allowed Rhode to move on her terms.

Track Your Real Returns, Not Just Your Spend

Marketing is only valuable if it drives growth. Rose Inc. spent heavily on visuals and retail placement, but failed to build a loyal customer base. Rhode, on the other hand, measured repeat purchase rate, lifetime value, and community growth from the start.

Make Every Product Launch a Story, Not Just a Drop

Consumers today don’t want more stuff—they want reasons to care. Rhode turned product releases into cultural moments. Rose Inc. released beautiful products with little emotional connection. The difference showed.

Culture > Credentials

People don’t buy products. They buy points of view. Hailey didn’t sell serums—she sold a lifestyle, a look, a ritual. Rose Inc., despite having biotech backing and Sephora placement, never cracked through culturally.

Ownership and Authenticity Always Show

You can’t fake founder energy. Rosie believed in Rose Inc., but lacked operational control. Hailey was in the room for every decision—and it showed. Consumers felt it. Investors noticed it. And retail partners respected it.

Conclusion: The Beauty of Control

The beauty industry is not for the faint of heart. It’s saturated, fast-moving, and ruthlessly competitive. Rose Inc. had the look, the credentials, and the retail deals, but it lacked control.

Rhode had the narrative, the restraint, and the ownership—and it thrived.

In an era where every founder is expected to have vision, the real question is:

Do they also have power?

Because in beauty, as in any business, glamour fades. But ownership lasts.

Metrics That Matter

Track what moves culture, money, and momentum.

1. Repurchase Rate:

The percentage of customers who return to buy from your brand again after their first purchase. This metric reflects customer loyalty and product satisfaction.

Repurchase Rate = (Repeat Customers ÷ Total Customers) × 100

Example: If you had 1,000 total customers last month, and 280 made another purchase:

(280 ÷ 1,000) × 100 = 28%

Why it matters: If people aren’t coming back, you don’t have a brand—you have a moment. A strong repurchase rate signals that you’re building something people trust and want to re-experience.

2. Earned Media Value (EMV):

The estimated dollar value of unpaid brand exposure generated through social media posts, press coverage, influencer mentions, and user-generated content (UGC). It reflects your cultural currency.

EMV = Impressions × Engagement Rate × Media Rate Benchmark

Example: If your product got 5M unpaid impressions across TikTok and Instagram, and the average CPM (cost per thousand impressions) is $20:

5,000 x $20 = $100,000 EMV

Why it matters: High EMV = buzz without budget. It’s a direct reflection of how much people want to talk about you.

Founder Retention:

The continued involvement and influence of a founder in the operational, creative, or strategic direction of the brand. Founder retention is a qualitative metric tied to ownership, decision-making power, and authentic brand identity.

How to evaluate:

Do you retain the majority equity (50%+)?

Do you hold a seat on the board?

Are you still involved in product, brand, or strategy decisions?

Why it matters: Without real power or presence, the brand risks losing its soul—and its founder-driven edge.

SKU-to-Story Ratio

The percentage of products (SKUs) in your lineup that are anchored in a clear, compelling story or cultural purpose. This measures narrative depth across your catalog.

SKU-to-Story Ratio = (Narrative-Driven SKUs ÷ Total SKUs) × 100

Example: You sell 12 products. Only 4 have unique positioning, customer rituals, or a real backstory.

(4 ÷ 12) × 100 = 33%

Why it matters: In an oversaturated market, a product without a story is invisible. The lower your ratio, the more forgettable your brand becomes.

Sell-Through Rate

The percentage of inventory sold compared to the amount originally available. It shows how well your products are performing in the market.

Sell-Through Rate = (Units Sold ÷ Units Available) × 100

Example: You drop 1,000 units of a new lip balm and sell 850 in a month.

(850 ÷ 1,000) × 100 = 85%

Why it matters: A strong sell-through rate = demand is real. Low sell-through = either weak marketing, poor fit, or overproduction.

Keep Up:

Worth the read/listen:

Under the Hood is where we dissect culture, strategy, and business moves that matter. Whether you’re bootstrapping a dream or scaling your empire or working on your side hustle, these are the receipts that help you move smarter.

Until next week.

Be bold. Be real. Be anomalous.